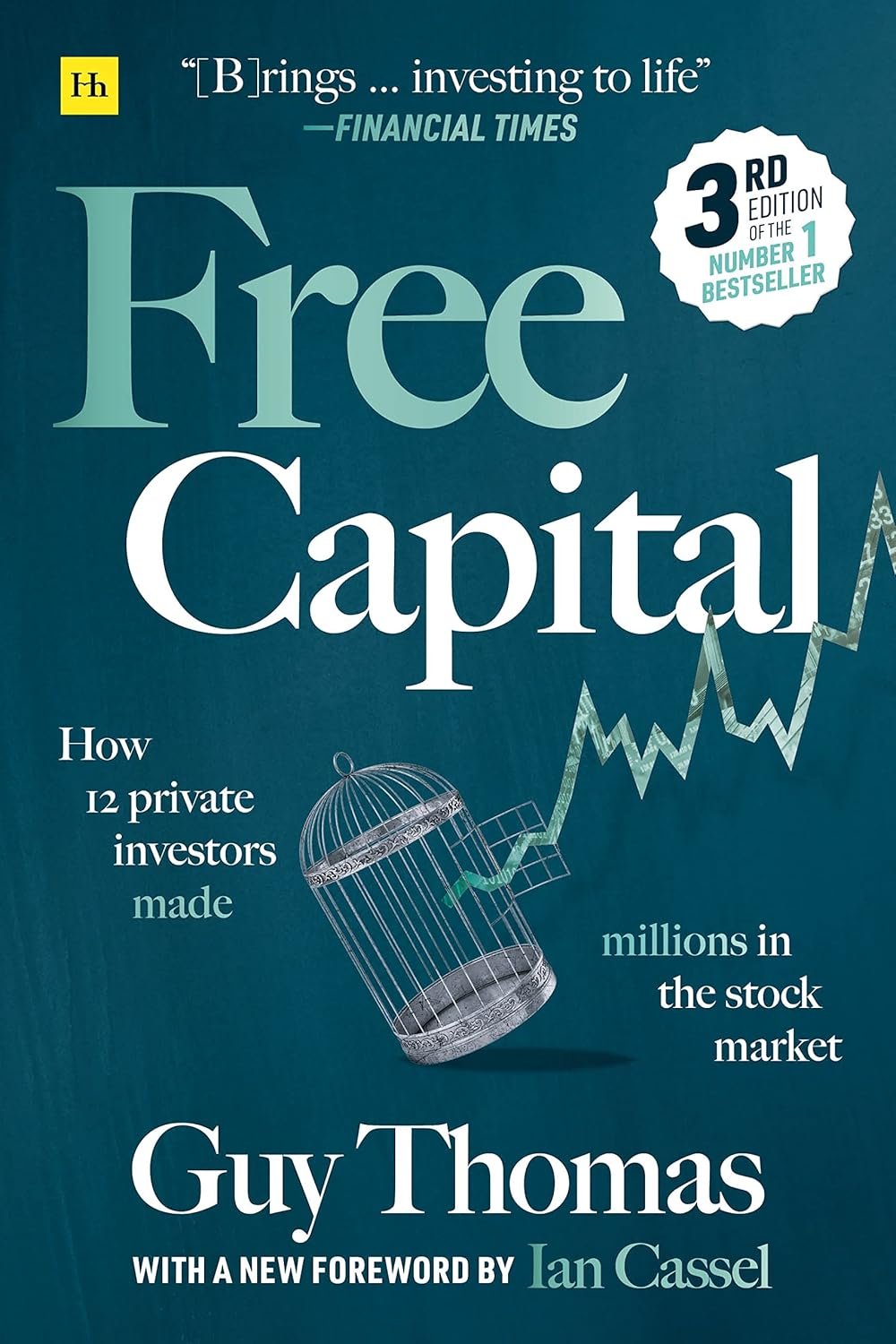

Price: ₹1,199 - ₹475.66

(as of Jan 01, 2025 00:00:55 UTC – Details)

3rd edition with new foreword by Ian Cassel Wouldn’t life be better if you were free of the daily grind – the conventional job and boss – and instead succeeded or failed purely on the merits of your own investment choices? Free Capital is a window into this world. Based on a series of interviews, it outlines the investing strategies, wisdom and lifestyles of 12 highly successful private investors. Each of them has accumulated $1 million or more – in most cases considerably more – mainly from stock market investment. Some have several academic degrees or backgrounds in professional finance; others left school with few qualifications and are entirely self-taught as investors. Some invest most of their money in very few shares and hold them for years at a time; others make dozens of trades every day, and hold them for at most a few hours. Some are inveterate networkers, who spend their day talking to managers at companies in which they invest; for others a share is just a symbol on a screen, and a price chart shows most of what they need to know to make their trading decisions. Free capital – money surplus to immediate living expenses – is the raw material with which these investors work. It can also be thought of as their psychological habitat, free from the petty tribulations of office politics. Lastly, free capital describes the footloose nature of their assets, which can be quickly redirected towards any type of investment anywhere in the world, without the constraints which institutional investors often face. Although it presents many advanced insights and valuable investment hints, this is not an overly technical book. It offers practical ideas and inspiration, with revealing detail and minimal jargon, making it an indispensable read for novice and experienced investors alike. *** This third edition of Free Capital follows the text of the second edition, published in 2013, with the addition of a new foreword by Ian Cassel. ***

Publisher : Harriman House; 3rd ed. edition (20 June 2024); Unit 3 Viceroy Court, Bedford Road, Petersfield GU32 3LJ UK

Language : English

Paperback : 300 pages

ISBN-10 : 0857198823

ISBN-13 : 978-0857198822

Reading age : 18 years and up

Item Weight : 1 kg 50 g

Dimensions : 16.41 x 1.65 x 22.99 cm

Country of Origin : United Kingdom

Importer : Pan Macmillan Publishing, 707, 7th Floor, Kailash Building 26, K.G. Marg, New Delhi, Delhi 110001

Packer : AAJ Enterprises; Khasra No. 91/7, Village Akbarpur Barota, Sector – 42, Distt. Sonipat, Haryana- 131101

Generic Name : Book

Customers say

Customers find the book informative and a good guide for individual investors. They appreciate the author’s writing style and find it an easy, valuable read with great content.

AI-generated from the text of customer reviews

GD –

How small guys won big in a stock market jungle

I have read many accounts of successful professional investors in many excellent books. But as a private investor I am always interested in learning success stories of small private investors who multiplied their own funds in the market using their investing acumen. I was looking for such acccounts on Net when I came across this book. The reviews looked encouraging so decided to buy it. I think I made a wise decision to buy this book. The profiled investors are just like any small investor with limited means. Many struggled with their jobs for various reasons and had to opt out of conventional career track. These people strated very small, had one or two early lucky breaks (like technology bubble gains) that gave them some funds to start. Today every one is millionaire. Some like Sushil has net worth of tens of millions british pound! Most achieved this in less than 20 years of investing. To author’s credit he has selected investors who follow different investing styles. One guy is even day trader. That was grating in otherwise excellent book but otherwise rest can be termed as genuine fundamental investors.This book can serve as a great inspiration to all individual investors even if you do not want to make a career out of it. These accounts show what is feasible even for individuals. But this book is especially a source of great value to all those who want to make investing their vocation/calling, those who want to get out of corporate rat race and experience freedom, financial independence & control over their time & life …by becoming ace investors themselves. The 12 stories written in this book are testominy to the fact that if you are “skilled enough” and have sufficient seed capital and you are frugal then full time investing can become a legitimate source of your livelihood and eventual freedom. But make no mistake that every one cannot possibly do what these guys did. Only few can be successful in stock investing to this extent and make a living managing just your own funds. In that sense these 12 guys are exceptional people no doubt. Their CAGR returns are in eye popping 25-40% range.Second edition covers the update on these guys 3 years after first edition came out. He has given update on how each one has fared from 2010 to 2013. It is notable that most of them have either beaten the bench mark indexes or matched the same performance (if that is your idea of success in investing!). One thing is clear they will accumulate millions more by the time they log out… although I am not so sure about that Day Trader.Another striking and pleasing factor for me was the realization that many of these successful investors are bottoms up value investors. It proves that value investing is not only for big shots but can also be source of wealth for small guys.Guy Thomas is himself a full time private investor and he understands nuances of investing. Although this is not a How To Get Rich manual he provides sufficient hints to the methods used by these invetsors and summarises at the end of each chapter for our benefit the wisdom and knowledge gained by each investor in his investing life. The author is good writer and the book was a fast read. I would reccoemnd this book as a must read for all those who dream of one day making personal investing their major calling. I also reccomend his blog and web site.Thanks Guy Thomas for writing this book. It was needed.Update in Oct 2021-I read this book and wrote my review just before I became a full-time private investor. It’s been almost 7 years now. In the interim, I have read this book at least 3 times. Every time I got something valuable out of it. The book covers many styles. A couple of ones resonated with me because they are akin to my own style of long-term investing. After all these years and the passage of time, I still believe that this book is a Must Read for private investors for education and inspiration. I am glad I read this book.

Chandragupta Acharya –

Short and sweet

This book is a collection of biographical sketches of 12 individual investors who have made a living exclusively out of investing in the stock markets. The individuals have varying academic backgrounds and previous job profiles usually unrelated to investing or fund management. All of them have exceptional track records and have built a fortune from very modest beginnings. The term âFree Capitalâ refers to the corpus of savings the individuals have started with, essentially what is left over from the regular income such as salary after meeting day to day living expenses. All the investors have different investing styles and taken a different path to success. The book amply demonstrates that when it comes to investing, there is no One Way that is the Right Way to success. You have to choose what suits your style and temperament, and evolve over a period of time. And yet, despite the differences in investing styles, it is interesting to see some common patterns emerge from the profiles of these investors. There are similarities in personality traits or even personal backgrounds in many of them.This is not a typical investment book, though there surely are many nuggets of investing wisdom. The book does not seek to teach how to invest, or provide a roadmap for making successful investments. The book narrates the personal stories of the profiled individuals, as brought out from their own detailed interviews and the authorâs external research on them. Free Capital is a small book that you can easily finish off in a few sittings.If you are looking for an inspiration in your investing journey, this book will do the job.

Goutham –

lifestyle of investors

it was an ok book .. it highlights different shades of investing – from long term top down/bottom up investors to traders..It covers details of style of 12 investors1.their style of investing2.their life style3.How they handled work along with investing4.what worked for them and what didnt5. their learningMost of the details are from other markets

Shashank V. Nerurkar –

Free Capital: How 12 Private Investors made millions in …

Free Capital : How 12 Private Investors made millions in the Stock Market is a very informative book and will act as an inspiration for private investors in equity markets. The book covers experiences of 12 private investors in U.K. who have made millions in equity markets. These are self-made multi-millionaires who left their jobs at different stages in their life to become full time investors. Their educational backgrounds are different from school drop-outs to highly educated. Their styles are different and have evolved over a period of time. The book is well organized and provides information about background of each investor, their style of investing, details of some of their successful investments (details of some mistakes as well), their daily routines. The book will act as an inspiration and as a guide to all budding as well as experienced equity investors.

Kindle Customer –

First book of individual investors

I wish there were more books like this, showing successes of retail investors rather than fund managers. Great concept something I always wanted to read. Writing could have been more interesting It seemed very narrative like author was giving a speech on everyone. But nevertheless great content

V RAVICHANDRAN –

A Good and Valuable Read

Can you make a living by investing in the Stock Market (and to a small extent trader therein), without inherited wealth. If yes, what has been the experience of people who have made such a living. Free Capital, profiles a dozen of people who have made it (though they are from UK) and they share their thoughts, ideas, background and the path they have taken. Guy Thomas presents a balanced view and peppers with carefully thought out checks and balances. Recall having read a similar book on Indian Market Gurus viz. India’s Money Monarchs – Chetan Parikh and others. Wish we have another book, covering the people of this era who make a living by Dalal Street. A Good and Valuable Read.

Michel Rubino –

it’s not in there. Fun read but not enough details on the process of each investor. Didn’t go deep enough.

Wayne J –

Written in a similar vein to John Trainâs Money Masters the author covers unknown private investors. A handy resource for investors looking for âreal worldâ examples rather than Hollywood style hedge fund managers with billions under management. My takeaway: concentrated investing in small companies with very little leverage appears to be a good way to start on the path to financial independence.

Oak Tree –

Excellent book, well written and giving good practical examples of what has worked for these people. Very interesting.Would definitely buy a follow up book as am sure there are more stories of people doing this out there. Could have done with more than 12 examples basically.

hemlock –

I enjoyed the book a lot. The book provides a nice cross section of independent thinkers and their take on investing.

Trader –

This is a great book to dip into though you can certainly read it from cover to cover. I found the introductory chapter most useful to start with — it’s an excellent guide to the author’s purpose and will help you to find the parts of most interest initially. The author has done extremely well to investigate and extract the thought processes and philosophies of his 12 subjects.It is apparent from these accounts that there is no Holy Grail of investment methodology. The interviewees are so diverse in temperament and methodology that it becomes evident that there are many ways of being a successful investor/trader and thus it’s the person rather than the methodology that is important. These highly successful investors are all clever people, some very highly qualified academically, others not. They are all highly individualistic and able to make their own decisions, sometimes contrarian but always in their own furrow. Some from humble financial and social backgrounds, they mostly appear to have come to terms with themselves and their lifestyles reflect an equilibrium even though some of them have unenviable medical histories.The more I read this book the more it fascinates me and in that respect it’s like the investment classics of Livermore, Schwager’s Market Wizards, & Loeb — every time you read it another little gem of information or idea becomes apparent. The author excels at explaining in non-jargonistic terms so much useful philosophical and financial discussion. Helpfully, he also includes some clear technical explanations for those wanting them.This book would make an excellent but modestly-priced present for anyone with an interest in trading the financial markets. Thoroughly recommended and a credit to its author who has donated his proceeds to charity.